Well outline them by situation. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967.

Format Personal Tax Docx Format Income Tax Payable For Individual Ali Rm S 4a Business Income 1 Gross Income Less Allowable Expenses Adjusted Course Hero

1099 for rental income.

. LIRC reduces the property class rate applied to. And 13 how all properties of a person are to be grouped in several categories in computing the statutory income under section 4d of the Act. If you are a partner include the net rental income or loss from your T5013 slip in the calculation.

Applicable for Year Assessment YA 2018 to 2020. But theres a difference between rental income and business income. For a forward-looking estimate of rent and income limits see the Novogradac Rent and Income Limit EstimatorThe Rent Income Limit Calculator has been updated for the FY 2022 HUD Income Limits and is being released in Beta form.

This also applies to furniture fixtures. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. This was introduced in Section 4 d of the Income Tax Act 1967 ITA.

Rental income tax is a tax imposed upon profit that you make from renting out properties. 467 income rule if the amount to be paid for the use of the rental property exceeds 250000 and under the agreement either. Generally this amount will be your taxable income from your rental property.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Advance rent Generally you include any advance rent paid in income in the year you receive it regardless of the period covered or the method of accounting you use. For instance they include.

Landlords of qualifying non-residential properties can refer to the Tax Treatment of Rental Relief Measures under the Rental Waiver Framework for Year of Assessment 2022. The exemption is applicable for each property if Adam has in excess of one property in this category. Expenses of renting property can be deducted from your gross rental income.

For assessment years 2022 and 2023 the first value tier is set at 100000. Once you divide the net annual income by the initial investment and express the result as a percentage you can start to determine whether or not you have found a good deal. 4c is the distribution amount and 4d is the taxable amount if the distribution amount and 4d is the taxable amount are different.

The firsttier limit was previously adjusted annually by the average statewide change in estimated market value of property classified as class 4a apartments and 4d low. Well cover that in the next section. If the amount is.

If youre renting a property for business purposes however your rental income is filed under Section 4a of the Act under business income. The Department of Revenue certifies the limit each November 1 for the upcoming assessment year. It is still being tested for potential errors or.

However the rent earned by letting out vacant land is not taxed under this category but is. The tenants are entitled to use the swimming pool tennis court and other facilities that are provided in the apartment. The 1040 lines 4c and 4d come from the 1099-R and your answers to the interview questions.

Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. Annual income includes amounts derived during the 12-month period from. Section 2562 of the Excise Tax Act allows landlords who buy or build new residential housing.

When computing the rental gain to be disclosed in tax filings the gross rental income can. Rental income is assessed on a net basis. Combine the rental income and loss from all your properties even if they belong to different classes.

These rules are generally effective for rental agreements entered into after June 8 1984 with some exceptions. Landlords of qualifying non-residential properties would also have received a cash grant in 2020 and are required to. Rental income is filed under Section 4d of the Income Tax Act 1967.

Typically the rental income tax forms youll use to report your rental income include. Azrie owns 2 units of apartment and lets out those units to 2 tenants. There are three types of 1099 rental income related forms.

According to Nolo returns between 4-10 percent are reasonable for rental properties. If all of the distribution amount is taxable then it will only be on 4d. Tax class 4d should be expanded to include 1 income- and rent-restricted units currently excluded by a provision that at least 75 of the units on a property meet certain eligible requirements and 2 projects funded only by local governments.

Before declaring your rental income to LHDN you should start from the rental income sources. Therefore if more than one 1099-R it is entirely. 12 the situations or circumstances where rent or income from the letting of property can be treated as business income of a person under section 4a of the Act.

According to the Income Tax Act rental income of a property is taxed under Section 24 in the hands of the owner under the head income from house property. If youre renting a property for business purposes however your rental income is filed under Section 4a. Rental income is filed under Section 4d of the Income Tax Act 1967.

The Rent Income Limit Calculator is available with the compliments of Novogradac. It can be derived from immovable properties and movable properties. You may also deduct the expenses if theyre considered deductible expenses.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Fourth Adam is able to claim 50 exemptions on the tax on rental income if he. You generally deduct your rental expenses in the year you pay them.

The Low Income Rental Classification LIRC. Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment if you rent part of your property or if you change your property to rental use. A rental ROI of under 4 percent is not typically worth the investment unless there.

For rental income received in 2021 Under the Rental Relief Framework owners ie. Form 1040 or 1040-SR Schedule E. Rents out his residential properties at a rate below RM 2000 a month.

Annual income includes all amounts that are not specifically excluded by regulation. Rules Under Tax Law. Reporting rental income on your tax return.

Such rental income is explained under Section 4d of the Act. Part 3Finding Taxable Income. Exhibit 5-1 Income Inclusions and Exclusions provides the complete list of income inclusions and exclusions published in the regulations and Federal Register notices.

The legalese gets complicated so lets break. Agreements for the rental of tangible property are subject to the IRC Sec. Expenses paid by a tenant If your tenant pays any of your expenses those payments are rental income.

Subtract your total expenses on Line 20 from your total income on Line 3 and enter the result on Line 21. But theres a difference between rental income and business income.

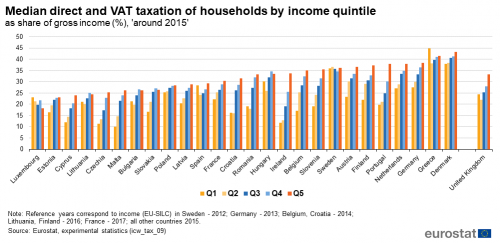

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

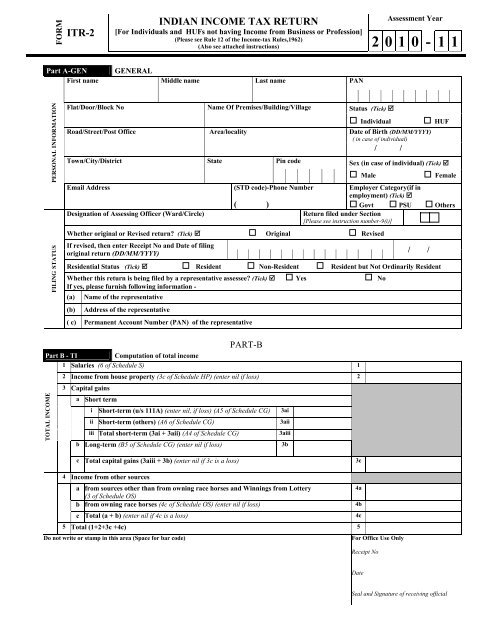

Income Tax Return Forms In India India Briefing News

Explore Our Sample Of Office Moving Budget Template For Free Spreadsheet Template Report Template Computer Maintenance

Taxation Principles Dividend Interest Rental Royalty And Other So

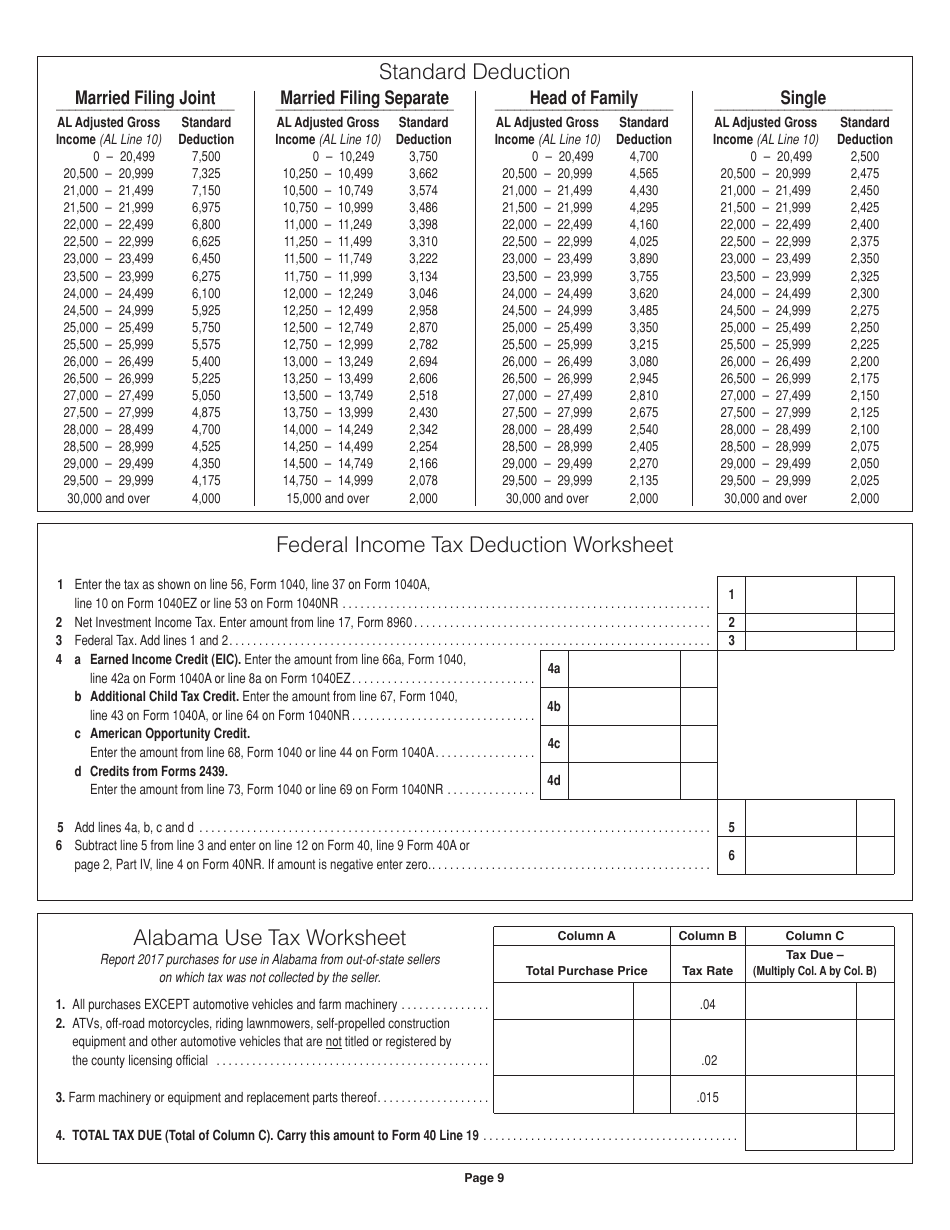

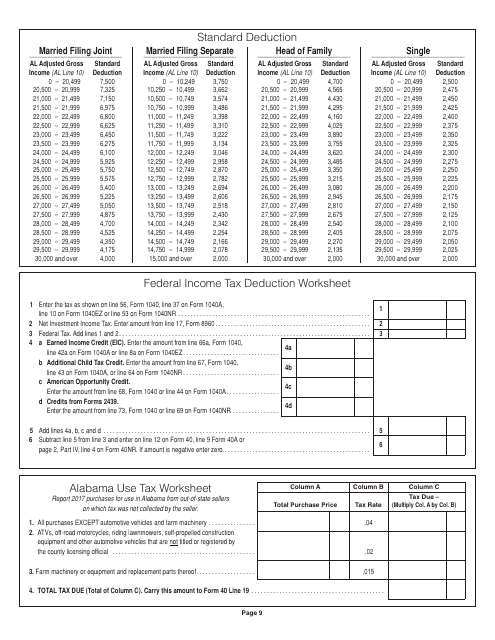

Alabama Federal Income Tax Deduction Worksheet Download Printable Pdf Templateroller

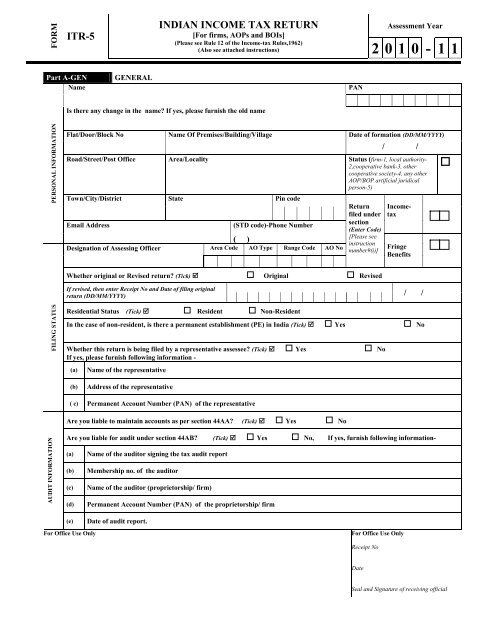

Rm Itr 5 Indian Income Tax Return Income Tax Department

Income Tax Return For Financial Year 2020 2021 A Y 2021 22 Manthan Experts

Why Hra Generator Is Important Income Tax Income Tax Return Tax Refund

Itr 5 Indian Income Tax Return Income Tax For Ngos

Itr 7 Indian Income Tax Return Income Tax For Ngos

How To Keep Track Of Rental Property Expenses Rental Property Spreadsheet Template Rental Property Management

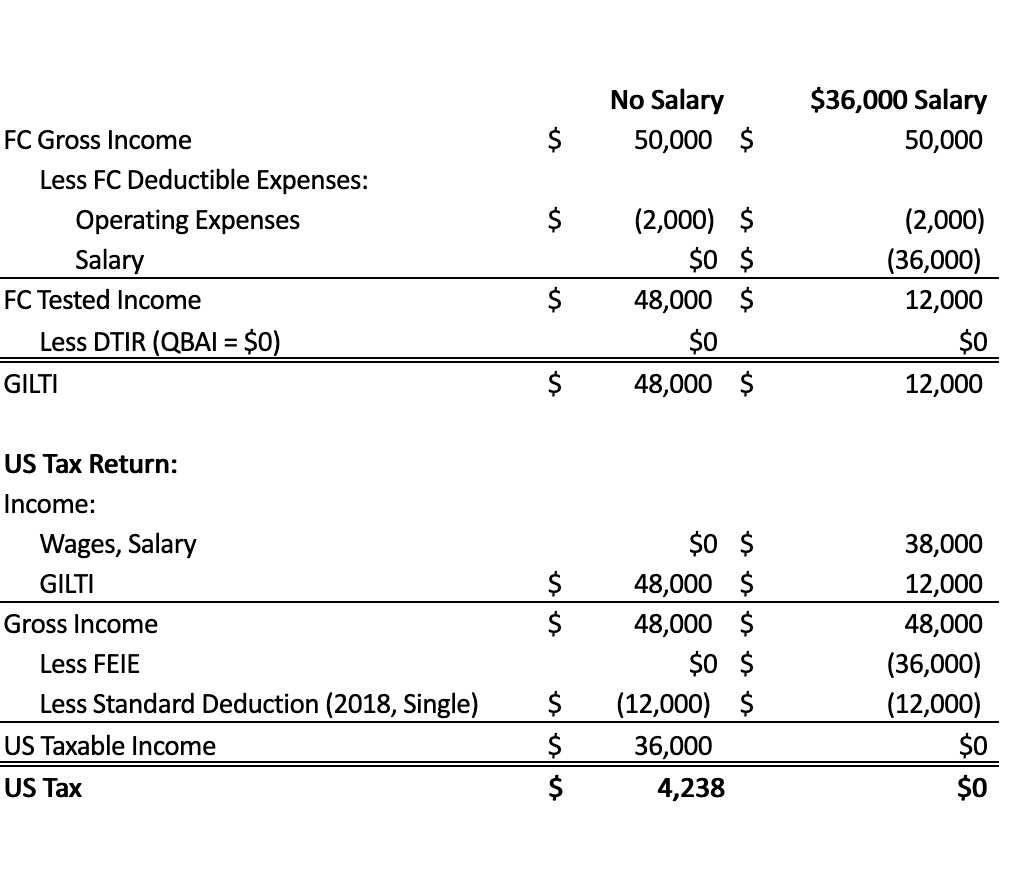

Getting To Know Gilti A Guide For American Expat Entrepreneurs

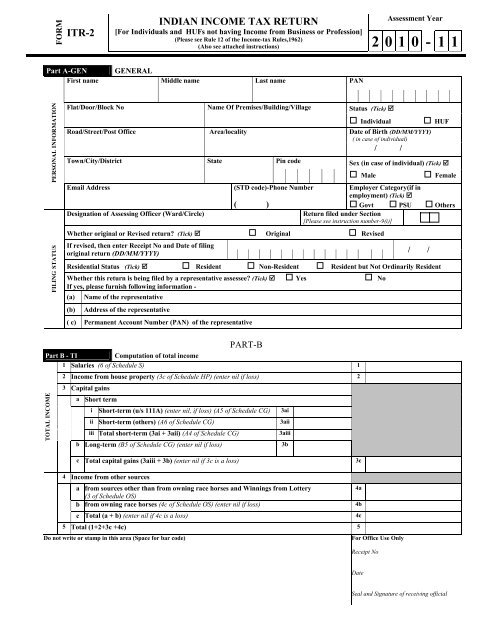

Rm Itr 2 Indian Income Tax Return Income Tax For Ngos

Wacc Calculation Accounting And Finance Finance Lessons Finance Investing

Alabama Federal Income Tax Deduction Worksheet Download Printable Pdf Templateroller

Solved Put The Given Details Below In The Bir Form 1700 For Mixed Earner Course Hero

Iowa Do Not Resuscitate Form Templates Iowa Legal Forms